Bank Guarantee

Bank Guarantee Process

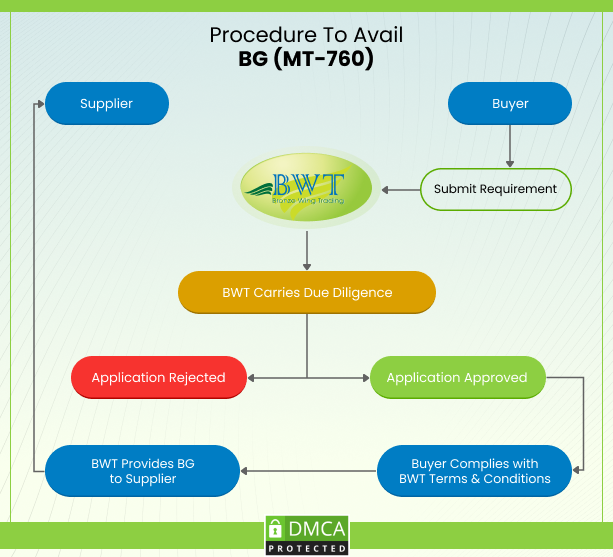

Follow the Bank Guarantee Process mentioned below to apply Guarantee Letter from Rated Banks without blocking cash funds:

- At first, the client needs to submit their trade deal by sending a buy and sell agreement or proforma invoice for their trade deal or contract.

- Next, our team will study their BG request. And then, we will inform the party whether the request is approved or not.

- If approved, we will sign the service agreement with the client. After that, we will inform them about the admin charges to start working on their BG request.

- Once the client pays the admin charges, we will start working on their request by blocking our bank limit. Then, we will send the BG draft for their review; also, will inform them about the BG issuance fees.

- After the receipt of the BG issuance fee & Draft approval, we will instruct our bank to open a BG from our own account on behalf of the client. Finally, it will transmit via authenticated SWIFT MT760 to the counter party’s account.

Submit Your Requirements

We will get back to you within 24 working hours

Bank Guarantee Video

Latest Transaction

MT760 Issued to US Client for Gloves Import Deal

Nitrile Gloves import deal between the US Buyer & the Malaysian Supplier was concluded successfully with the use of Bank Guarantee issued from our rated Bank Account. As the direct issuer of BG MT760, we helped our clients with their BG needs without blocking cash funds.

Amount:

USD 2,225,400

Instrument:

BG MT760

Validity:

1 Year

Bank Guarantee Available for ZERO Collateral

What is a Bank Guarantee?

Bank Guarantee is a written undertaking issued by a bank on behalf of their client to assure the payment commitment towards the counterparty. For instance: If a buyer wants to procure bulk goods; then the seller may request the buyer to provide an MT760. Hence, this assures the seller that the buyer will meet their commitment as agreed in the contract.

Since MT760 gives the required assurance, BGs are mostly used by traders while doing overseas trade dealings. Further, with BG, traders can do multiple deals with global sellers that they would not be able to make without BG. Also, having BGs can help traders to acquire goods, drawdown loans; also, to secure contracts and lease agreements without tying their cash funds. Likewise, nowadays, in this trade market, traders tend to manage and expand their business worldwide with the use of BGs.

Having BG MT760 stands as proof of your solid financial standing and can confirm your credit strength to your local & foreign sellers, as well, can attract more businesses. So, if you are looking to apply for a Letter of Guarantee to sign a new import contract; then, you can get help from Bronze Wing Trading L.L.C., the Bank Guarantee Providers in Dubai. This is because we have experience with the provision of different types of BGs on behalf of traders and contractors from rated European Bank Accounts at ZERO Collateral.

Importance of Bank Guarantee in International Trade

Usually, Bank Guarantees gives the payment commitment towards the seller, on behalf of the buyer. On the other hand, if the seller is unable to supply the product, then they will be liable to pay the penalty to the buyer as per the amount agreed in the contract. Hence, MT760 protects both parties from any kind of default or risks.

As it secures both parties from fiscal risks, sellers & buyers often prefer to do business using MT760s. Also, apart from reducing the risks involved, this helps traders to establish good credit status with new vendors.

Bank Guarantees in Construction

Bank Guarantees are used in construction contracts when the value of the construction work is high! Usually, project owners prefer to work with contractors; who can provide MT760 to assure the commitment under the contract. On the other hand, having BGs proves the contractor’s resources, & manpower; to perform the work without any delays or default.

Further, there are different Types of Bank Guarantees (*mentioned below) that are available for contractors to sign worthy projects without blocking their cash funds.

Get your Letter of Guarantee within 48 Hours

Parties Involved in Bank Guarantee

- A Buyer – Known as an applicant who applies for BG MT760

- Issuing Bank – The issuer who issues the required MT760

- Seller – Who Receives the Issued BG

- Beneficiary Bank – The one who receives the BG on their client’s behalf.

Benefits of Bank Guarantees

- Allow the buyer to secure better contracts or trade deals.

- There is no need to make an advance payment or tie up all your capital in a single deal. And so, you can spread around; also, can do more deals at a time.

- Less paperwork, so you can focus on your core business.

- The seller can perform quickly without asking for advance payment. Also, it protects them against the risks involved in the payment of the supplied goods or services.

- Finally, with BG, the buyer can gain a reliable trader status in both local and global markets.

Types of BG

Performance Bank Guarantee is issued by the seller in favor of the buyer. In brief, this bond compensates; if a seller fails to perform as per the agreed contract. In this case, the buyer needs to claim against Surety bond from the seller’s bank. However, the buyer can claim only a certain amount i.e. around 2% to 5% of the total contract value.

When a seller asks for advance payments; the buyer can demand a Payment Guarantee from their seller. Hence, this secures the advance payment; in case, if the seller fails to fulfill their terms as set in the contract.